Seamless access to financial services for the underprivileged

About

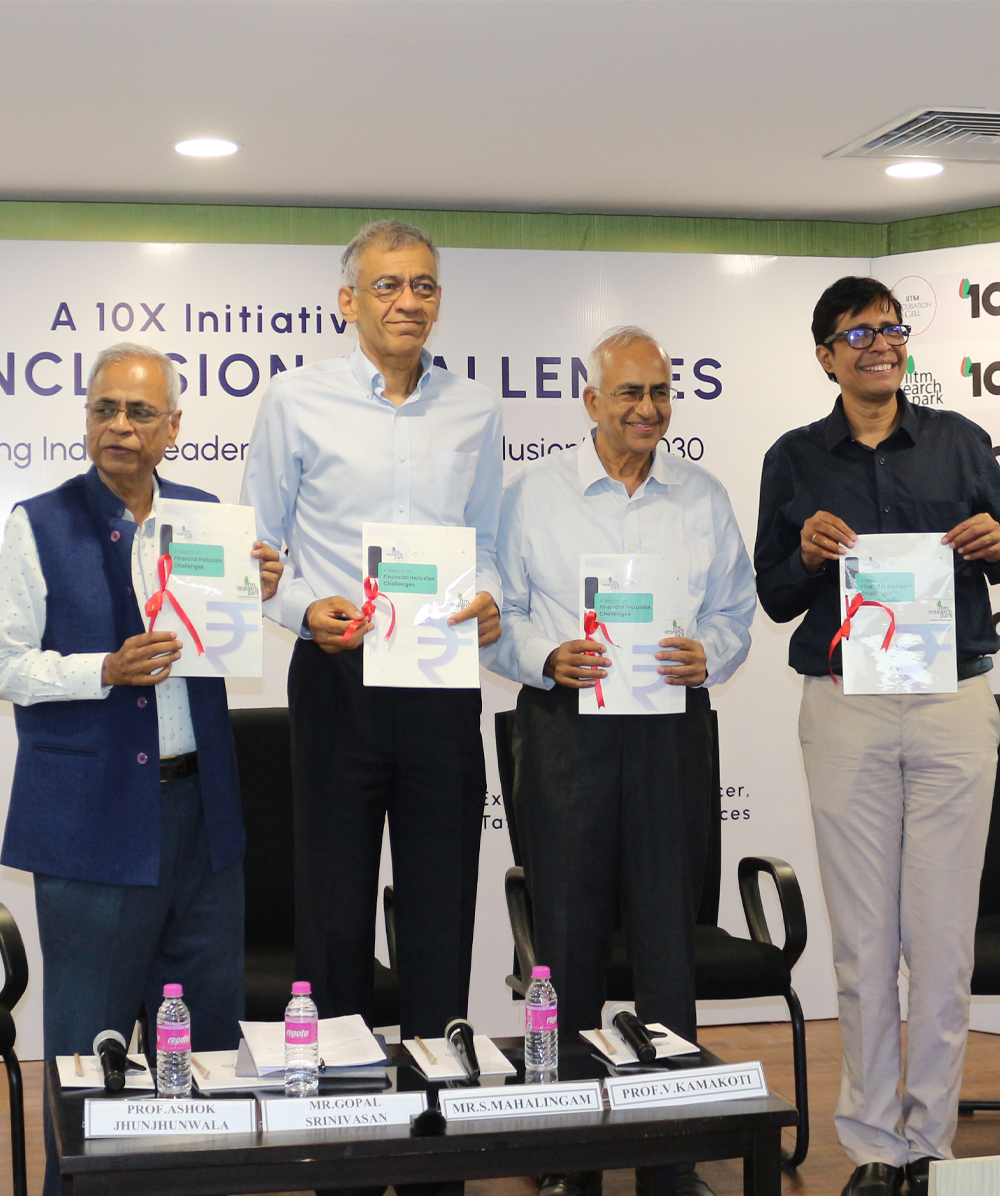

India is today home to the second-largest unbanked population in the world continuing to wrestle with increasing financial inequities. Over the last decade, we have developed one of the strongest ecosystems of Fintech companies and start-ups that focus on making organized financial services accessible to rural India and the lower-income population. Leveraging this ecosystem, our goal is to elevate India as a leader in ‘Fintech for Inclusion’ by 2030.

Partners

Fintech

for

Inclusion

RBIH – The Reserve Bank Innovation Hub (RBIH) facilitates accelerated technological innovation in the financial sector

Dvara Holdings – Dvara develops businesses designed to ensure that every individual and enterprise has complete access to financial services.

Stellapps – Stellapps provides end-to-end dairy technology solutions using its IoT network to set up data-driven financial services for dairy farmers.

Samunnati - India’s largest specialized agriculture value chain enabler providing Agri Commerce and Finance solutions to affiliated Farmer Collectives and the larger agri ecosystem.

Northern Arc Capital – Northern Arcprovides under-served households and businesses with efficient and reliable access to debt finance.

STPI FinBlue – FinBlue offers a collection of cloud-based APIs from banks, core banking software, payment gateways, and analytics tools to Fintech startups.

Cred Avenue - India’s largest debt marketplace which helps businesses and enterprises secure debt from lenders and increase efficiency across the entire debt value chain.

PayAgri - An agri-fintech organization that orchestrates and digitizes the entire transaction in an Agri Value Chain to optimize value for small holding farmers.

Agami Fintech - Agami brings millions of Indians, particularly migrant workers, casual laborers, and domestic service providers, into an organized financial system.

Vest-in-villages – Vest-in-villages works towards providing an easy-to-use scalable credit scoring and tracking tool to unbanked small & marginal farmers.

Agrosperity - An incubated startup developing an AgriTech platform that combines technology and last mile transaction capability to ultimately grow farmer income by 10x.

Kaleidofin – Kaleidofin is a fintech platform that propels under-banked customers towards meeting their real-life goals by providing intuitive and tailored financial solutions.

SETU - Setu is an Application Programming Interface (API) infrastructure start-up, which offers APIs across savings, credit and payments

Lead at Krea University - LEAD carries out transformative research engagements and partnerships, creating opportunities and solving socio-economic challenges.

RBIH – The Reserve Bank Innovation Hub (RBIH) facilitates accelerated technological innovation in the financial sector

Lead at Krea University - LEAD carries out transformative research engagements and partnerships, creating opportunities and solving socio-economic challenges.

Kaleidofin – Kaleidofin is a fintech platform that propels under-banked customers towards meeting their real-life goals by providing intuitive and tailored financial solutions.

Samunnati - India’s largest specialized agriculture value chain enabler providing Agri Commerce and Finance solutions to affiliated Farmer Collectives and the larger agri ecosystem.

Dvara Holdings – Dvara develops businesses designed to ensure that every individual and enterprise has complete access to financial services.

Northern Arc Capital – Northern Arcprovides under-served households and businesses with efficient and reliable access to debt finance.

Cred Avenue - India’s largest debt marketplace which helps businesses and enterprises secure debt from lenders and increase efficiency across the entire debt value chain.

PayAgri - An agri-fintech organization that orchestrates and digitizes the entire transaction in an Agri Value Chain to optimize value for small holding farmers.

Agami Fintech - Agami brings millions of Indians, particularly migrant workers, casual laborers, and domestic service providers, into an organized financial system.

Stellapps – Stellappsprovidesend-to-end dairy technology solutions using its IoT network to set up data-driven financial services for dairy farmers.

STPI FinBlue – FinBlue offers a collection of cloud-based APIs from banks, core banking software, payment gateways, and analytics tools to Fintech startups.

SETU - Setu is an Application Programming Interface (API) infrastructure start-up, which offers APIs across savings, credit and payments

Agrosperity - An incubated startup developing an AgriTech platform that combines technology and last mile transaction capability to ultimately grow farmer income by 10x.

Vest-in-villages – Vest-in-villages workstowards providing an easy-to-use scalable credit scoring and tracking tool to unbanked small & marginal farmers.

RBIH – The Reserve Bank Innovation Hub (RBIH) facilitates accelerated technological innovation in the financial sector

Lead at Krea University - LEAD carries out transformative research engagements and partnerships, creating opportunities and solving socio-economic challenges.

Kaleidofin – Kaleidofin is a fintech platform that propels under-banked customers towards meeting their real-life goals by providing intuitive and tailored financial solutions.

Samunnati - India’s largest specialized agriculture value chain enabler providing Agri Commerce and Finance solutions to affiliated Farmer Collectives and the larger agri ecosystem.

Dvara Holdings – Dvara develops businesses designed to ensure that every individual and enterprise has complete access to financial services.

Northern Arc Capital – Northern Arcprovides under-served households and businesses with efficient and reliable access to debt finance.

Cred Avenue - India’s largest debt marketplace which helps businesses and enterprises secure debt from lenders and increase efficiency across the entire debt value chain.

PayAgri - An agri-fintech organization that orchestrates and digitizes the entire transaction in an Agri Value Chain to optimize value for small holding farmers.

Agami Fintech - Agami brings millions of Indians, particularly migrant workers, casual laborers, and domestic service providers, into an organized financial system.

Stellapps – Stellappsprovidesend-to-end dairy technology solutions using its IoT network to set up data-driven financial services for dairy farmers.

STPI FinBlue – FinBlue offers a collection of cloud-based APIs from banks, core banking software, payment gateways, and analytics tools to Fintech startups.

SETU - Setu is an Application Programming Interface (API) infrastructure start-up, which offers APIs across savings, credit and payments

Agrosperity - An incubated startup developing an AgriTech platform that combines technology and last mile transaction capability to ultimately grow farmer income by 10x.

Vest-in-villages – Vest-in-villages workstowards providing an easy-to-use scalable credit scoring and tracking tool to unbanked small & marginal farmers.